The insurance industry, which has, for far too long, been marred by overly manual processes, is now undergoing a significant transformation. At the heart of this transition is the adoption of customer relationship management (CRM) systems to streamline operations, enhance user experiences, and boost profitability. That’s why the global customer relationship management market size is estimated to reach USD 163.16 billion by 2030. But do they really deliver? As it stands today, many insurance companies find themselves replacing or re-implementing their CRM within just a few years.

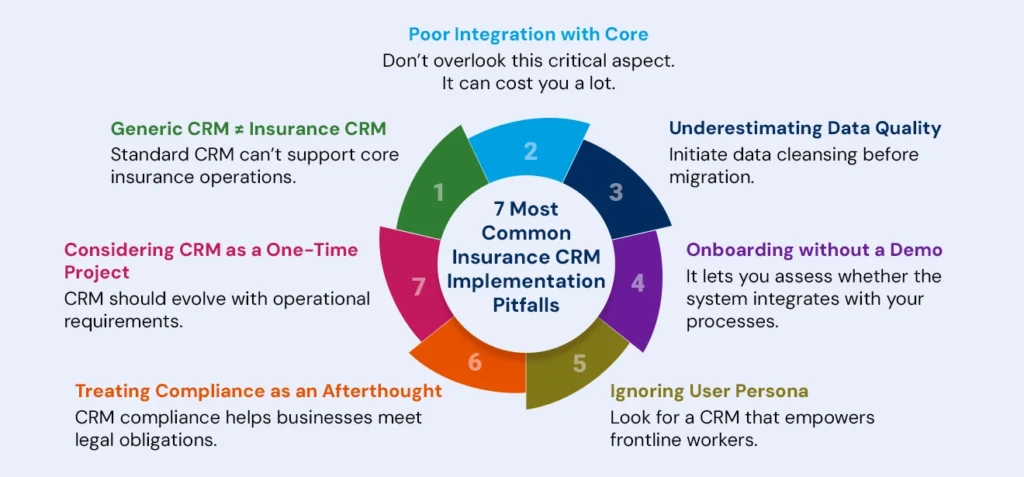

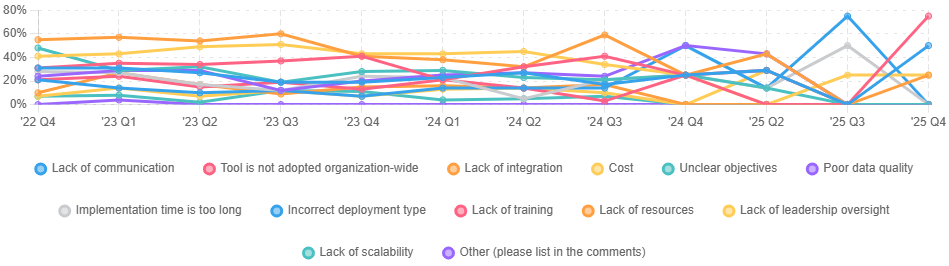

The reasons? Poor integration with core systems, misaligned expectations, lack of measurable ROI, low user adoption, and poor data quality. A good insurance CRM should foster collaboration among multiple functions, such as brokers, underwriters, agents, policyholders, and service teams. How can you identify the right fit for your operations? In this article, we break down seven pitfalls that you must avoid, so you will be better positioned to onboard a CRM that truly integrates with your existing workflows. But first, let’s understand the inevitable need for CRM in the insurance business.

Why Do Insurance Businesses Need CRM Today?

In-person interactions, manual processes, extensive paperwork, and disparate legacy systems have long powered insurance businesses. Records have often been maintained in on-premises databases that are seldom updated in real time. Customers wait in long queues for their queries to be addressed, such as during claim filing. Even after this, there is little visibility into the claim cycle, and users wait days for updates. But this manual process still thrived (well, survived), and customers continued with their insurer because there were few alternatives.

Today, people have had a taste of digital-first experiences. Customers will happily switch to a competitor at a minor inconvenience. Amazon, Apple, and Zappos are prime examples of brands that excel in customer service. That’s why the need for a CRM solution has never been greater, including in complex industries such as insurance. That said, there are certain measures insurers must consider before implementing a CRM system.

Seven Reasons Why Insurance CRM Systems are Failing (And How to Overcome Them)

Pitfall 1: Treating a Generic CRM Like an Insurance CRM (Vendor vs. Domain Fit)

Insurance CRMs are built differently from the generic, horizontal ones. Standard CRMs can’t natively map policies, coverages, and endorsements, and are primarily designed to support standard customer management use cases, such as centralizing data and personalizing communications. While these key benefits are crucial for operational success, they are not sufficient for insurance products and operations, which are fundamentally complex. An insurance-first CRM can drive core operations such as policy management, claim processing, automate FNOL, and trigger renewals. This solution can seamlessly integrate with your existing core systems, facilitate user adoption, and often require less customization (in most cases).

Before investing in an insurance CRM solution, ask the vendor you finalize the following questions:

- What makes your CRM different from the ones available in the market for the same price?

- Do you have pre-built functionality for auto-renewals, underwriting assessments, and customer service?

- Have you worked with a business of our size and expertise? Can you share some case studies?

Pitfall 2: Overlooking Integration with Core Systems and Legacy Tools

Lack of integration is often the biggest obstacle insurers face in implementing CRM software. Core insurance systems such as policy administration, claims management, underwriting, billing, and multichannel sales contain invaluable data. If an insurance CRM can’t integrate with these industry-specific workflows and manage regulatory requirements, then it’s better to skip this investment. Because instead of CRM, it would merely function as a glorified contact database that you have to pay for until your agreement ends. That means you’re back to square one.

- Agents may have to manually re-enter data from different systems, as the CRM isn’t able to capture information entered across workflows in real time.

- Discrepancies arise between policy details in the CRM and the source of truth, resulting in inconsistent, inaccurate reporting.

- Users resist using the CRM and prefer to continue using spreadsheets, emails, and legacy systems because they are more familiar with them.

What to Do Before Selecting a CRM

- Explicitly list your core systems (underwriting, claims, billing, policy renewal).

- Document required data flows and how they become a unified, single source of truth.

- Importantly evaluate the vendor’s API capabilities, pre-built connectors, and integration experience.

Pitfall 3: Underestimating Data Quality and Migration Complexity

Insurance organizations are sitting on data goldmine. These vast, often untapped reserves are waiting to be explored. However, the challenge is that these huge volumes of data sets are sitting in silo, fragmented systems such as legacy CRMs, spreadsheets, or lost in your inbox. Bringing all this into a new CRM without an adequate data-cleansing strategy could result in duplicate records.

For example, the workforce may have earlier incorrectly added a different address for the same policy number on two different departmental tools (54th Avenue – 55th Avenue). A common data entry error. If this isn’t identified head-on, then the new CRM would also show similar outdated, incomplete results. Addressing these early reduces long-term headaches.

Here are some data strategy tips that you must follow to get a clean 360-degree unified customer view:

- Identify what historical data is truly essential.

- Use data cleansing and deduplication tools before migration.

- Prioritize high-value, high-usage data first.

Pitfall 4: Choosing a System Without Testing or a Demo

Would you invest in a property without an on-site visit? Or buy a car without a test drive? Probably not. Yet many companies choose a CRM solely on a great sales pitch, or the benefits outlined in the brochures. Insurers pour thousands of dollars into tools without practical testing. Because that CRM solution is either famous or has rave reviews/customer testimonials online. But there’s no one size-fits-all.

A CRM that may have worked for the other businesses in the past may not necessarily work well for your operations. Inappropriate customization and feature overload are among the biggest technological errors.

That’s why a demo has become so crucial. It lets you assess whether the system integrates well with your processes, meets your team’s needs, and increases ROI. Without testing, you risk onboarding a tool that your workforce may resist using.

Pitfall 5: Ignoring User Personas and Frontline Adoption

An insurance business employs underwriters, agents, inside sales representatives, claim adjusters, and service representatives. Each of these users serves a different, equally important purpose to maintain operational continuity. An insurance business seeking to procure a CRM solution must examine features/functions that empower frontline workers to fulfill their duties. A common mistake is purchasing a tool that:

- Encompasses workflows built for management reporting and not for daily users

- Features a complex UI/UX that’s not mobile-friendly and can overwhelm the workforce

Result: Low adoption rates → CRM becomes another “unused tool.”

Here’s how you can increase adoption:

- Conduct user interviews to understand actual workflows, identify gaps, and understand areas of improvement.

- Involve key personas, including underwriters and claim adjusters, in demo testing to gain their trust and make them feel heard.

- Prioritize ease of use and automation-led initiatives to reduce manual tasks, such as sending renewal reminders.

Pitfall 6: Treating Compliance, Auditability, and Security as Afterthoughts

Insurance is one of the most regulated industries worldwide. Organizations are required to comply with laws such as the Health Insurance Portability and Accountability Act (HIPAA), the General Data Protection Regulation (GDPR), and local insurance authorities. Because policies contain sensitive details such as patient health information, biometrics, and home address. That’s why a CRM solution must support strict compliance requirements and data privacy standards. These should be an extension of a CRM system and must not be treated as an afterthought.

According to PwC’s Global Compliance Study 2025, 85% of respondents feel that compliance requirements have become more complex in the last three years. Always include your compliance and information security teams during CRM evaluation. This can help you finalize a platform that meets regulatory standards.

Pitfall 7: Considering CRM as a One-Time Project, not a Change Program

As your business strategies evolve, so does your CRM. But too many insurance teams treat CRM implementation as a standalone project. Common mistakes identified:

- Minimal training development programs

- No roadmap for incremental enhancements

- Unable to monitor outcomes.

For example, AI is now an integral part of every operational workflow. Businesses are aggressively investing in AI programs to accelerate innovation and boost productivity. A CRM that an insurance business may have acquired a few years ago must now include AI agents as a key part of its value proposition. AI agents are particularly useful for automating administrative tasks and clarifying complex systems.

Follow these recommendations to stay ahead:

- Establish a governance model that includes both business and IT stakeholders.

Roll out CRM implementation in two phases:

Phase 1: Core rollout (policy integration, workflows).

Phase 2: Autonomous AI agents, analytics.

- Track adoption, productivity, and business value to measure the efficacy of CRM adoption.

Conclusion: Look Beyond Numbers

Many times, insurance leaders ask us: “There are so many CRM selection mistakes and step-by-step recommendations to overcome them. But how can we deftly turn these insights into a real-world opportunity?” Our mantra is simple: it’s not that difficult. Understanding these seven pitfalls helps you become more contextually aware and ask the right questions at the right time when evaluating CRM vendors. Because you don’t need to invest your money in a CRM, that ends up becoming an underutilized IT tool. Instead, emphasis should be laid on a thoughtful CRM selection that can actually become a real growth engine.

Don’t look for the cheapest or the most feature-rich option. No, we’re not undermining their potential. But in our experience, that’s only the tip of the iceberg that most insurers go for. To become a differentiator and maximize ROI, the first step is to understand your business needs, data landscape, regulatory context, and workforce who will use the CRM every day. A few extra days of due diligence to evaluate your current state can help you avoid poor adoption rates and missed opportunities and ultimately build more profitable customer relationships.

To help you navigate the myriads of options in the market (next step), we present to you InsuraCRM, a powerful, centralized CRM platform. This highly flexible CRM passes the seven pitfalls seamlessly, empowering insurers to meet changing customer expectations and remain profitable.